Best Bankruptcy Attorney Tulsa for Dummies

See This Report about Chapter 13 Bankruptcy Lawyer Tulsa

Table of ContentsNot known Facts About Chapter 7 Bankruptcy Attorney TulsaThe 9-Second Trick For Tulsa Bankruptcy AttorneyThe Basic Principles Of Top-rated Bankruptcy Attorney Tulsa Ok The Buzz on Bankruptcy Law Firm Tulsa OkWhat Does Chapter 7 Bankruptcy Attorney Tulsa Mean?

The statistics for the other primary type, Phase 13, are even worse for pro se filers. Suffice it to claim, speak with a legal representative or 2 near you who's experienced with insolvency regulation.Numerous lawyers likewise provide complimentary appointments or email Q&A s. Take benefit of that. Ask them if insolvency is undoubtedly the right option for your situation and whether they believe you'll certify.

Ads by Cash. We may be compensated if you click this ad. Advertisement Since you've determined bankruptcy is indeed the right training course of action and you hopefully removed it with a lawyer you'll need to get begun on the documents. Before you dive right into all the main bankruptcy types, you ought to obtain your own documents in order.

Fascination About Best Bankruptcy Attorney Tulsa

Later on down the line, you'll actually need to verify that by revealing all types of details concerning your monetary events. Here's a fundamental listing of what you'll require when driving ahead: Determining records like your chauffeur's license and Social Protection card Tax returns (up to the previous four years) Proof of revenue (pay stubs, W-2s, freelance revenues, income from properties as well as any revenue from government benefits) Bank statements and/or pension statements Evidence of value of your possessions, such as lorry and realty valuation.

You'll want to understand what kind of financial debt you're trying to settle.

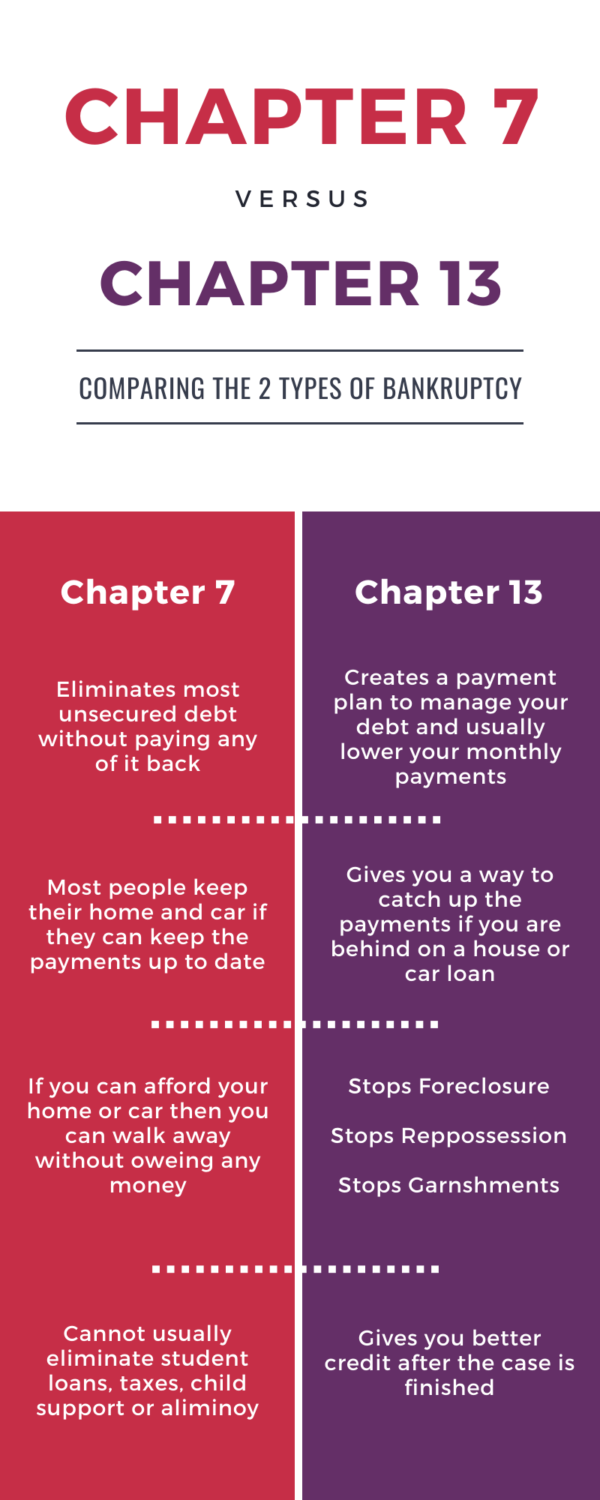

You'll want to understand what kind of financial debt you're trying to settle.If your income is too expensive, you have one more choice: Phase 13. This option takes longer to settle your financial obligations because it requires a long-lasting repayment strategy usually three to 5 years before a few of your remaining debts are cleaned away. The filing process is likewise a whole lot a lot more complex than Phase 7.

How Experienced Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.

A Phase 7 personal bankruptcy remains on your credit history record for ten years, whereas a Phase 13 bankruptcy diminishes after seven. Both have enduring effect on your credit rating, and any brand-new financial debt you obtain will likely feature higher rate of interest. Prior to you submit your personal bankruptcy types, you need to first complete a mandatory training course from a credit history you can check here counseling company that has been approved by the Department of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The program can be completed online, personally or over the phone. Programs generally set you back in between $15 and $50. You have to complete the course within 180 days of declaring for bankruptcy (bankruptcy attorney Tulsa). Utilize the Division of Justice's site to find a program. If you stay in Alabama or North Carolina, you have to select and finish a program from a checklist of separately authorized carriers in your state.

The 30-Second Trick For Affordable Bankruptcy Lawyer Tulsa

Check that you're filing with the right one based on where you live. If your copyright has actually moved within 180 days of filling up, you ought to file in the district where you lived the greater portion of that 180-day period.

Typically, your bankruptcy lawyer will certainly deal with the trustee, but you may require to send out the person papers such as pay stubs, income tax return, and checking account and charge card declarations straight. The trustee who was simply assigned to your situation will quickly set up a necessary conference with you, referred to as the "341 meeting" since it's a demand of Area 341 of the united state

You will certainly require to give a prompt listing of what qualifies as an exemption. Exceptions may put on non-luxury, main lorries; necessary home products; and home equity (though these exceptions rules can differ extensively by state). Any kind of home outside the Discover More checklist of exemptions is considered nonexempt, and if you don't provide any type of checklist, then all your residential property is taken into consideration nonexempt, i.e.

You will certainly require to give a prompt listing of what qualifies as an exemption. Exceptions may put on non-luxury, main lorries; necessary home products; and home equity (though these exceptions rules can differ extensively by state). Any kind of home outside the Discover More checklist of exemptions is considered nonexempt, and if you don't provide any type of checklist, then all your residential property is taken into consideration nonexempt, i.e.The trustee would not sell your sports car to instantly repay the lender. Instead, you would certainly pay your lenders that amount over the course of your repayment strategy. An usual misunderstanding with personal bankruptcy is that once you file, you can quit paying your debts. While insolvency can aid you eliminate several of your unsafe financial obligations, such as past due clinical bills or personal fundings, you'll want to keep paying your regular monthly settlements for secured financial debts if you desire to keep the residential or commercial property.

The smart Trick of Affordable Bankruptcy Lawyer Tulsa That Nobody is Discussing

If you go to threat of foreclosure and have worn down all other financial-relief choices, then applying for Phase 13 may delay the repossession and help conserve your home. Ultimately, you will certainly still require the income to continue making future home loan payments, along with paying back any kind of late settlements over the training course of your layaway plan.

If so, you might be required to provide additional information. The audit might postpone any financial obligation alleviation by several weeks. Naturally, if the audit shows up incorrect information, your instance can be disregarded. All that said, these are fairly uncommon circumstances. That you made it this much in the process is a suitable sign at the very least several of your financial debts are qualified for discharge.